The world of equity markets is constantly evolving, and the traditional system of Initial Public Offerings (IPOs) has come under scrutiny. Enter Andy Altahawi, a thought leader known for his analysis on the financial world. In recent discussions, Altahawi has been prominent about the possibility of direct listings becoming the preferred method for companies to attain public capital.

Direct listings, as opposed to traditional IPOs, allow companies to list their shares without underwriting. This framework has several advantages for both corporations, such as lower expenses and greater openness in the method. Altahawi argues that direct listings have the capacity to revolutionize the IPO landscape, offering a more streamlined and open pathway for companies to raise funds.

Public Exchange Listings vs. Standard IPOs: A Deep Dive

Navigating the complex world of public market initiation can be a daunting task for burgeoning businesses. Two prominent pathways, public exchange listings and standard initial public offerings (IPOs), offer distinct advantages and disadvantages. Direct exchange listings involve listing company shares directly on an popular stock exchange, bypassing the demanding process of a traditional IPO. Conversely, Adamson Brothers classic IPOs involve underwriting by investment banks and a rigorous due diligence process.

- Selecting the optimal path hinges on factors such as company size, financial stability, compliance requirements, and investment goals.

- Traditional exchange listings often appeal companies seeking rapid access to capital and public market exposure.

- standard IPOs, on the other hand, may be more appropriate for larger enterprises requiring substantial funding.

Ultimately, understanding the nuances of both pathways is crucial for companies seeking to navigate the complexities of public market entry.

Delves into Andy Altahawi's Analysis on the Emergence of Direct Listing Options

Andy Altahawi, a experienced financial expert, is shedding light on the disruptive trend of direct listings. His/Her/Their recent/latest/current analysis/exploration/insights delve into the mechanics of this alternative/innovative/evolving IPO model. Altahawi highlights/emphasizes/underscores the positive aspects for both companies and investors, while also addressing/simultaneously examining/acknowledging the challenges/risks/complexities inherent in this unconventional/non-traditional/novel approach/strategy/methodology.

- Direct listings offer/Provide/Present a viable alternative/compelling option/distinct path to traditional IPOs.

- Altahawi's perspective/analysis/insights are particularly relevant/highly insightful/of great value in the current/evolving/dynamic market landscape.

- Investors/Companies/Stakeholders should carefully consider/thoroughly evaluate/meticulously assess the implications/consequences/outcomes of direct listings.

Navigating Direct Listings: Insights from Andy Altahawi

Andy Altahawi, a prominent figure in the field of direct listings, offers invaluable insights into this innovative method of going public. Altahawi's knowledge encompasses the entire process, from preparation to implementation. He underscores the merits of direct listings over traditional IPOs, such as reduced costs and boosted autonomy for companies. Furthermore, Altahawi details the challenges inherent in direct listings and provides practical guidance on how to overcome them effectively.

- Through his extensive experience, Altahawi enables companies to arrive at well-informed decisions regarding direct listings.

Notable IPO Trends & the Impact of Direct Listings on Company Valuation

The current IPO landscape is experiencing a shifting shift, with direct listings increasing traction as a popular avenue for companies seeking to attract capital. While traditional IPOs continue the dominant method, direct listings are challenging the evaluation process by removing underwriters. This development has significant consequences for both issuers and investors, as it affects the perception of a company's intrinsic value.

Considerations such as regulatory sentiment, corporate size, and sector characteristics influence a crucial role in shaping the effect of direct listings on company valuation.

The evolving nature of IPO trends requires a thorough understanding of the capital environment and its impact on company valuations.

Andy Altahawi's Take on Direct Listings

Andy Altahawi, a influential figure in the investment world, has been vocal about the benefits of direct listings. He asserts that this approach to traditional IPOs offers substantial benefits for both companies and investors. Altahawi points out the flexibility that direct listings provide, allowing companies to go public on their own terms. He also envisions that direct listings can generate a more fair market for all participants.

- Furthermore, Altahawi supports the potential of direct listings to democratize access to public markets. He suggests that this can advantage a wider range of investors, not just institutional players.

- Despite the rising adoption of direct listings, Altahawi understands that there are still obstacles to overcome. He prompts further debate on how to enhance the process and make it even more transparent.

Ultimately, Altahawi's perspective on direct listings offers a thought-provoking analysis. He proposes that this innovative approach has the capacity to transform the structure of public markets for the advantage.

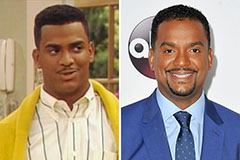

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!